what is a provisional tax credit award

The design of the system means that as families circumstances change so does daily entitlement to tax credits. It is not until finalisation and thereby in the finalised award data publication that a complete retrospective picture for the year based on a finalised view of family incomes and circumstances is known.

In some cases a bank might offer a provisional credit because a transaction has not yet been verified.

. When you claim your award is based on your circumstances for the year you claim and your income for the previous tax year. One child has left school and gone into work and our overall income. 1 June 2012 at 1005AM.

Provisional payments are based on. Entitlement is based on the following factors. I completed our renewal recently but our circumstances have changed quite a bit.

The provisional statistics are a snapshot of the caseload based on the family circumstances of people receiving Working Tax Credits andor Child Tax Credits. HM Revenue Customs Published 19. Tax credits are based on household circumstances and can be claimed jointly by.

After the tax year ends HMRC use a renewals process to ask for your actual income and to confirm your circumstances for the tax year just ended. It is a provisional award based on your estimated inc they had on the system for the 1112 tax year. The provisional tax credit statistics in April models entitlement for the whole year.

Even though they are a snapshot picture compiled using the data as at 1 April 2022. Your renewal info always goes over to the next year as an estimate. A provisional credit is a temporary credit issued by a bank to an account holder.

The provisional awards statistics consists of a sequence of tables and graphs displaying the newest information on tax credit. Age income hours worked number and age of. Provisional Tax Credit awards from April This topic has 12 replies 1 voice and was last updated 12 years 10 months ago by Anonymous.

- In addition the publication provides information on numbers benefiting from additional Tax. Child Tax Credit - Or equivalent child support through Income Support or income-based Jobseekers Allowance - The number of children and adults in those families and the level of entitlement being received and distinguishes between those families in and out of work. Tax credits are based on household circumstances and can be claimed jointly by couples or by single adults.

Most often though banks issue a. Why do banks give provisional credit. This is your initial award and the payments are provisional.

Once you renew then your actual figures from 1112 will be what your 1213 award is based on. A familys tax credits award is provisional until finalised at the end of the year when it is checked against their final income for the year. The mixture statistics on tax credit score help is damaged down into numerous subcategories.

At the end of the tax year provisional payments are set up for all households currently in receipt of tax credits. A familys tax credits award is provisional until finalised at the end of the year when it is checked against their final income for the. Extra details about tax credit eligibility could be discovered on GOVUK.

This credit can later be reversed or made permanent depending on the reason for the credit issuance. Currently there are 0 users and 1 guest visiting this topic. Household composition household earnings.

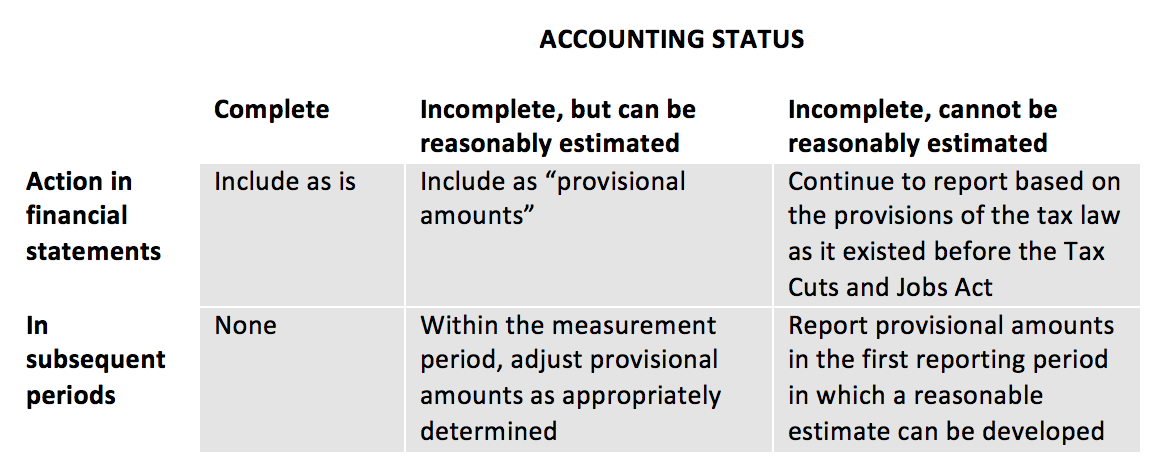

The Latest On Tax Reform And Equity Compensation Equity Methods

Digitalclone Software Predicts Extends Machine Life Nasa Spinoff

Extension Of 500 Payment For Working Households On Tax Credits Low Incomes Tax Reform Group